massachusetts estate tax table

If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax. From Simple To Complex Taxes Filing With TurboTax Is Easy.

Massachusetts State 2022 Taxes Forbes Advisor

990000 - 840000 150000 x 56 8400 8400 27600.

. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000. The estate tax is a transfer tax on the value of the decedents estate before distribution to any beneficiary. An estate valued at 1 million will pay about 36500.

References throughout this Note to the estate tax are to the. Up to 100 - annual filing. Section 2 Computation of estate tax.

Wills Trusts Probate Tax More. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents gross estate prior to deductions exceeds the threshold.

Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million. Ad Massachusetts Virtual Estate Planning Attorneys. The Massachusetts estate tax is calculated by.

File With Confidence Today. Expert legal advice without leaving your home. The Note identifies the property included in the gross estate and explains available deductions and exclusions and the tax calculation.

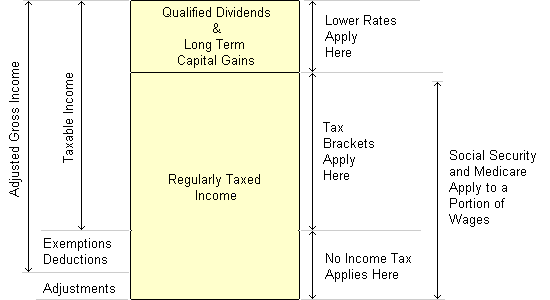

Certain capital gains are taxed at 12. Tax on certain property located in commonwealth. Section 3 Exemption and deductions.

Masuzi March 3 2018 Uncategorized Leave a comment 43 Views. 1050000 - 60000 990000. The estate tax is computed in graduated rates based on the total value of the estate.

Massachusetts Estate Tax. The state sales tax rate in massachusetts is 625 but you can customize this table as. It also discusses filing the Massachusetts estate tax and paying the estate tax.

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. The imposed Massachusetts estate tax is determined by the percentage of the taxable estate which is real and tangible property located in Massachusetts. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

Massachusetts state estate tax law key 2020 wealth transfer tax numbers moved south but still taxed up north mass estate tax 2019 worst. Section 4 Nonresident decedents. On top of this the federal estate tax may also apply Do you have to file inheritance tax in Massachusetts.

The Massachusetts State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Massachusetts taxable estate is 940000 990000 less 50000. Calculating the estate tax as if the decedent had been a resident of Massachusetts.

Provide accurate and useful information and latest news about Massachusetts Estate Tax Rate Table instruct patients to use medicine and medical equipment and technology correctly in order to protect their health. Massachusetts Estate Tax Table. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000.

Additionally because the taxable estate of 1050000 exceeds 1000000 the estate tax due is 20500. 17 rows Tax year 2021 Withholding. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Note that the above estate values are given after administrative and estate expenses. Computation of the credit for state death taxes for Massachusetts estate tax purposes. The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. 22 rows The bottom of the threshold is 6040 million so we subtract that from 62 million and get. Calculating the ratio of the Massachusetts situs real and.

A Practice Note discussing the key aspects of the Massachusetts estate tax law. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. The top estate tax rate is 16 percent exemption threshold.

How much estate tax will my estate have to pay. Your estate will only attract the 0 tax rate if its valued at 40000 and below. Schedule your free consultation today.

For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. Everyone whose Massachusetts gross income is 8000 or more must file a Massachusetts personal income tax return on or by April 15th following. Everything You Need to Know SmartAsset The Massachusetts estate tax rates range from 0 16 and apply to estates valued over 1 million.

If youre responsible for the estate of someone who died you may need to file an estate tax return. The Massachusetts Department of Revenue is responsible. In this example 400000 is in excess of 1040000 1440000 less 1040000.

The Massachusetts Department of Revenue is responsible. Discover Tax Table For Massachusetts for getting more useful information about real estate apartment mortgages near you. Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust.

Section 3A Qualified terminable interest property. Section 2A Transfer of estate and real property. So even if your estate isnt large enough to owe federal estate tax.

Ad Answer Simple Questions About Your Life And We Do The Rest. If youre responsible for the estate of someone who has died you may need to file an estate tax return. The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022.

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

What Is An Estate Tax Napkin Finance

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State And Local Individual Income Taxes Work Tax Policy Center

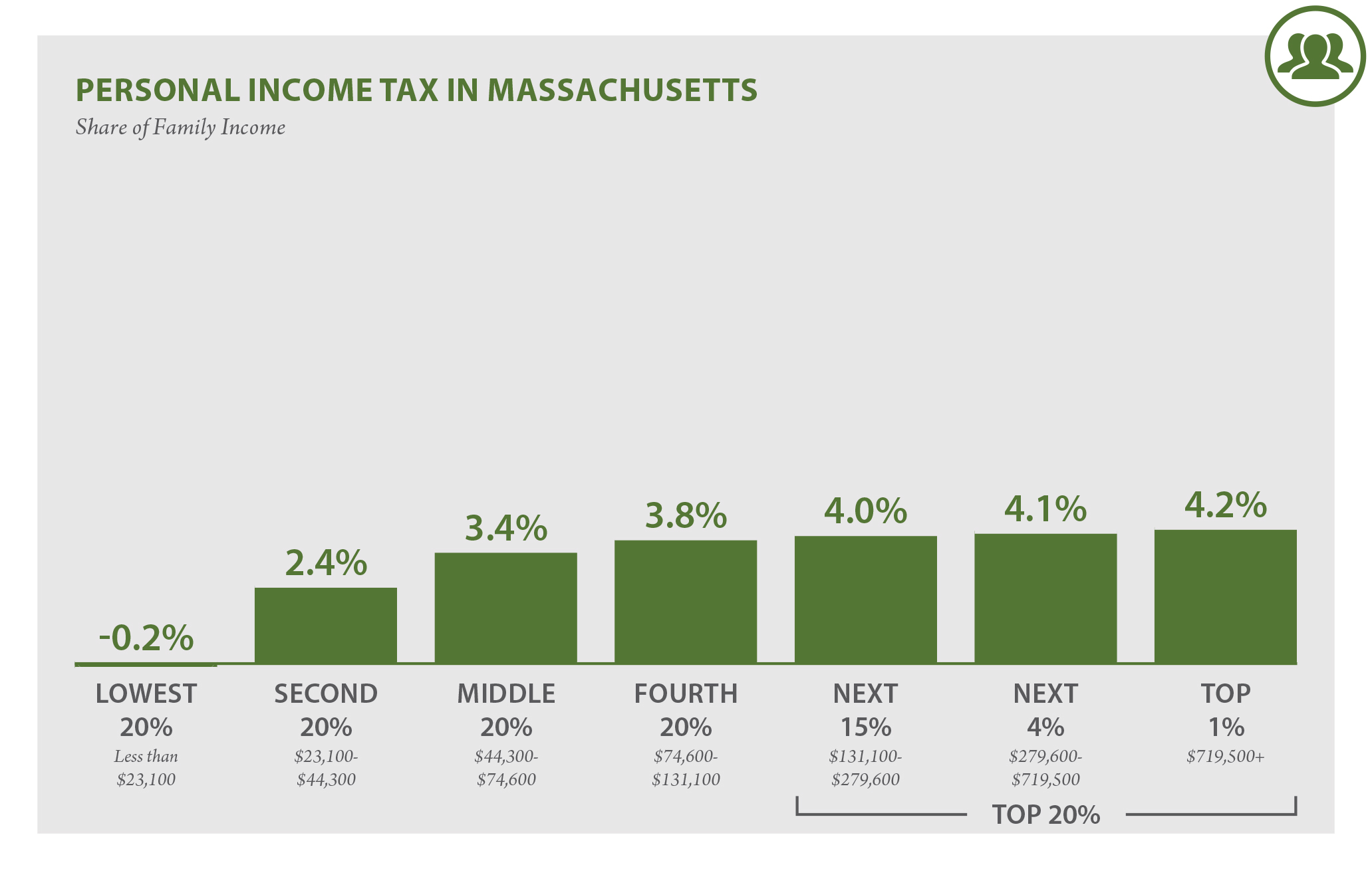

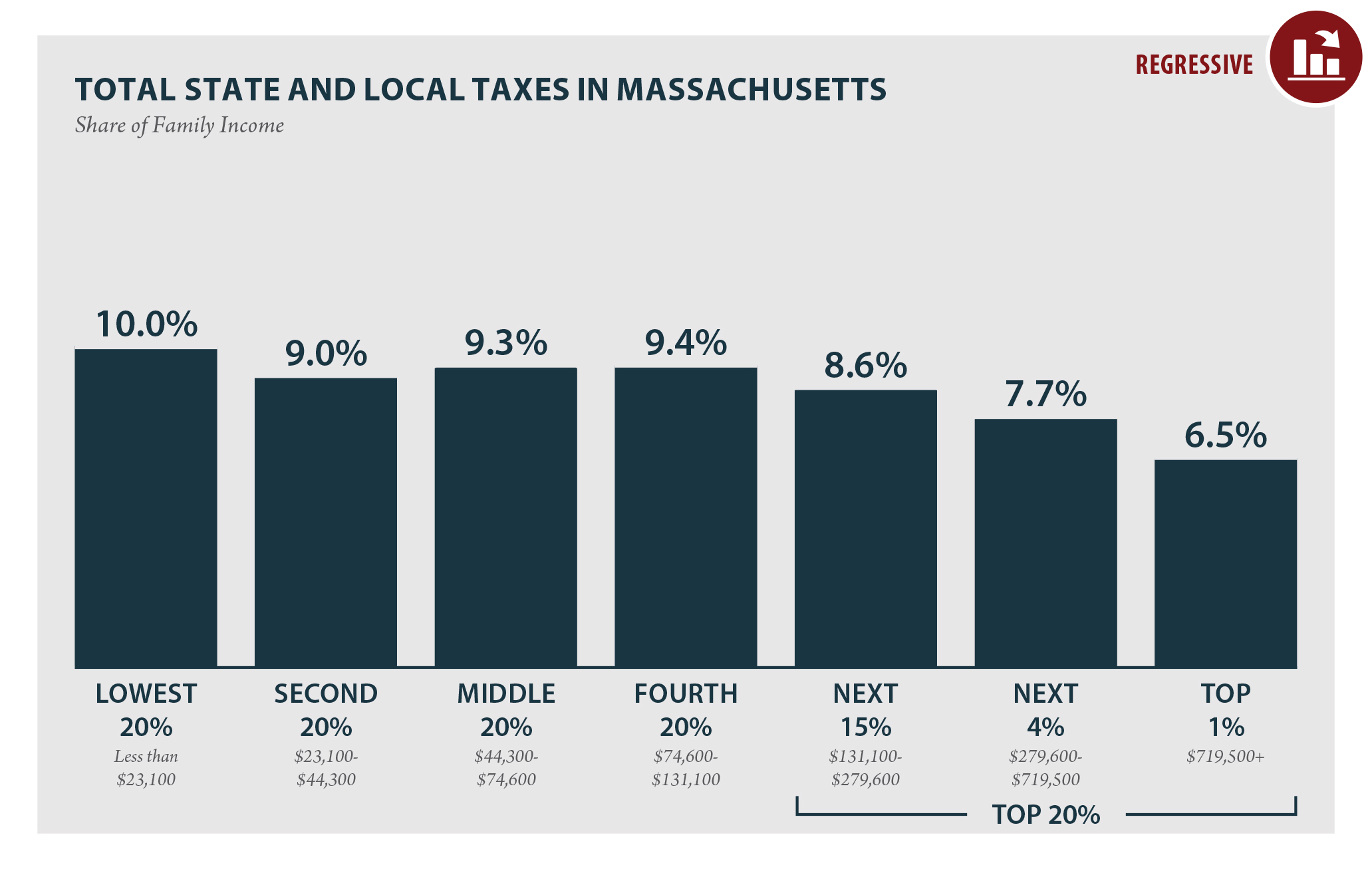

Massachusetts Who Pays 6th Edition Itep

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

What Is An Estate Tax Napkin Finance

Massachusetts Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Massachusetts Who Pays 6th Edition Itep

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)